我们着火了!bob账号客户端Permabond发射高强度,防火粘合剂TA4230

bob账号客户端Permabond很高兴宣布推出其新的快速固化,高强度阻燃的粘合剂TA4230,该粘合剂TA4230是第三名…

Permabond拥有世界各地的办事处,提供了专家技术帮助,产品建议,样品,实bob账号客户端验室测试,甚至为所有行业开发定制配方。我们提供短的交货时间和最低订单数量,即使对于自定义配方

bob账号客户端Permabond提供一致的高质量工业粘合剂产品,以确保客户生产线快速,平稳地运行,与我们联系以进行免费生产线审核或帮助将工业粘合剂材料引入全自动或手动生产线。

我们的销售和技术专家得到了全球分销商网络的支持,以协助您满足所有联系和密封需求。有关产品包大小,粘合剂可用性和当地分销商的联系方式的信息,请联系您所在地区的Permabond。bob手机版网页体育一键下载bob账号客户端单击此处以获取联系信息

bob账号客户端Permabond开发和制造工程胶粘剂的历史跨越了七十年。

bob账号客户端Permabond为世界各地的工程师提供技术解决方案,并在欧洲拥有高科技ISO 9001认证生产工厂的支持下,在美国,亚洲和欧洲提供办公室和设施。

bob账号客户端Permabond生产了许多类型的工业粘合剂产品,以适应许多不同行业的各种需求。

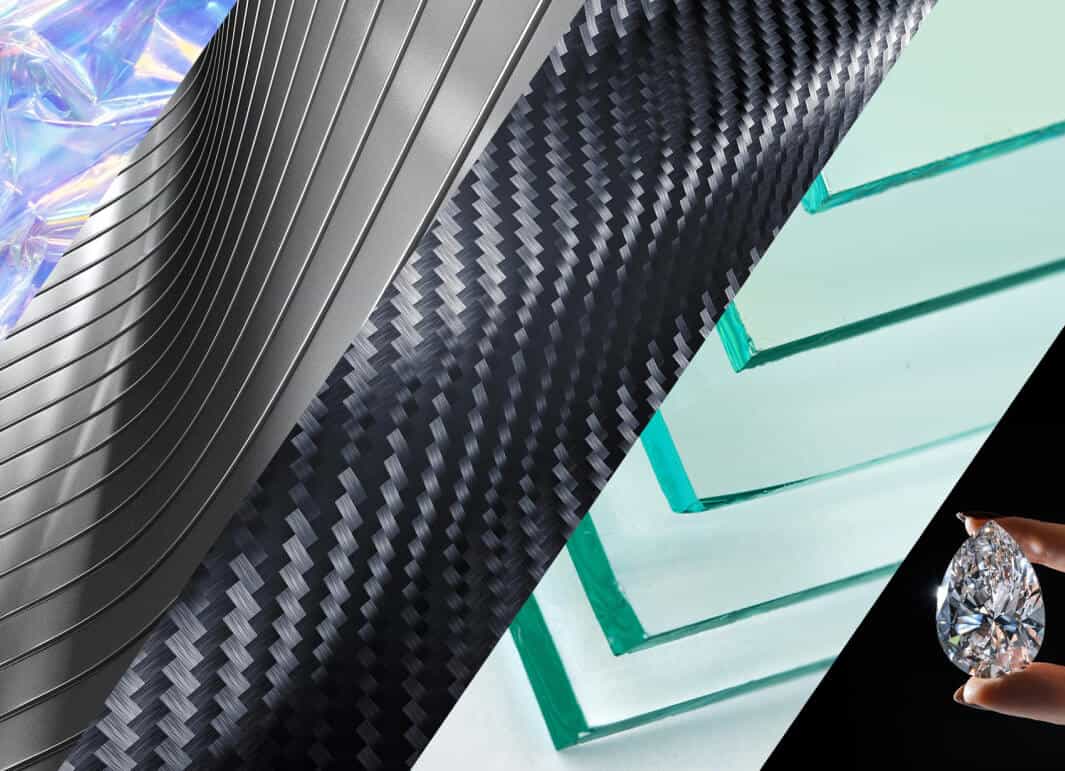

bob账号客户端粘合胶粘剂的能力粘合了多种不同的材料。无论您是想粘合塑料,金属,复合材料,木材,玻璃或橡胶,permabond都将有助于找到满足您需求的最佳产品。bob账号客户端

我们的技术团队喜欢挑战,因此,今天就与他们联系以获取建议,即使是最难以结合的基板!点击这里查看更多信息。

了解更多

bob账号客户端Permabond专门的技术顾问团队能够通过粘合性选择,试验和生产线实施来帮助和支持客户。我们技术创新的高质量产品范围旨在满足最艰难的粘结要求。

不断开发新产品,以承受更具挑战性的条件,将更多的新型和具有挑战性的工程材料结合起来,并达到更高的标准。

我们的专家团队可以帮助您确定我们现有产品之一是否可以满足您的需求,或者是否需要自定义配方。